$MSTR: Is the Strategy Broken?

People don't understand... Market is gifting us the opportunity we waited for

Strategy:

MSTR Crashed While Bitcoin Didn’t…

Paradox of Panic

While Bitcoin has been incredibly stable around ~$100,000, MicroStrategy (MSTR) is a different story. MSTR has dropped 47% from its 2025 high and is now, for the first time trading below the market value of its Bitcoin holdings.

The popular critique from the X crowd is relentless: $MSTR is a scam, a ponzi or an irresponsible leveraged play. Critics are blind to history: this volatility is normal (recall the $15k crash in 2022). More importantly, they misunderstand the entire thesis: Bitcoin isn’t a trade — MSTR definitely isn’t. It’s an amplified bet on the long-term ‘Store of Value’. Yet most people still don’t understand what they bought.

The Core Failure: The mNAV Delusion

I’m not going to pretend MSTR was a great trade this year. Even if BTC heats up again in 2026, recovery likely won’t be happening because the mNAV bubble needed to burst.

mNAV (Multiple of Net Asset Value) is simply a ratio: the company’s market cap divided by the value of its BTC holdings.

mNAV > 1.0 = Premium (The market pays extra for the strategy).

mNAV < 1.0 = Discount (The market values the box less than the Bitcoin inside).

The mNAVs got a little crazy earlier this year when the BTC-treasuries trade went euphoric. At one point new treasuries were trading at 10x their net asset value. That premium only looked “rational” initially because investors assumed:

Rapid BTC accumulation would follow

Future holdings baked into today’s valuation.

BTC would surge to new ATH every week…

= Justifying premiums…

But once the hype cooled and capital raising slowed, those premiums collapsed back toward NAV or straight into discount territory.

What I think happened here is the market just matured. The insane mNAVs never made sense. Even if Adam Back’s ‘Days to Cover mNAV’ metric was useful in the chaos, in hindsight though? It aged badly… I might have to retcon one of my earlier posts. (Nah it stands)

Now people are crying as if they were robbed… But Bitcoin and or MSTR isn’t a trade…

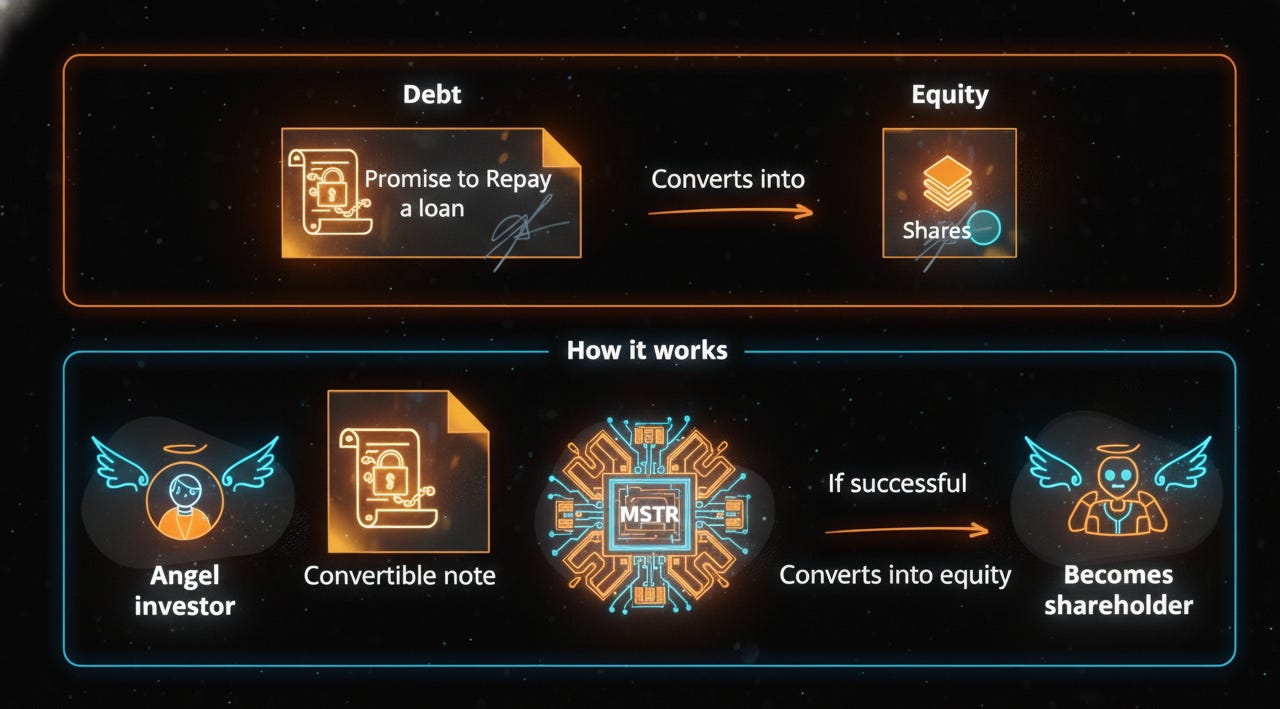

Amplified Bitcoin?

The amplified aspect refers to using borrowed money (debt) and issuing stock (equity) to purchase more Bitcoin than the company could with its operating cash flow alone. This is the “Strategy” you are buying.

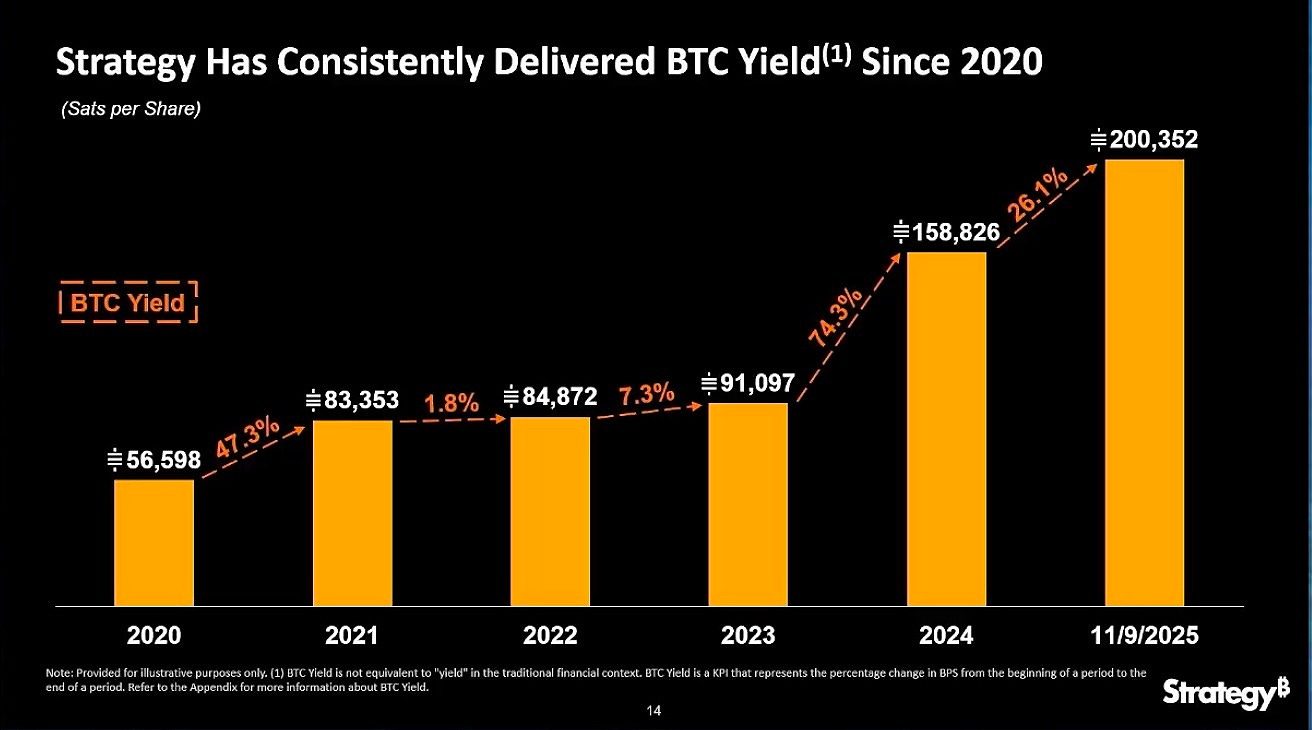

This started out as a crazy idea, but now with 600,000+ on MSTR’s balancesheet and the majority acquired this last year alone… = It’s safe to say Saylor’s “Strategy” hasn’t failed yet.

Why a Premium Ever Made Sense in the 1st Place?

Every cycle someone asks the most predictable question:

“Why not just buy Bitcoin instead of MSTR?”

First of all most people forget how hard it used to be to actually buy Bitcoin. Coinbase wasn’t always an app on your homescreen. $MSTR effectively built a global portal for exposure before infrastructure matured.

Secondly, owning MSTR is like boarding a corporate train that does one thing:

convert other people’s money (equity + debt) into BTC and? → more BTC.

Sure, I can buy Bitcoin with my own cash → MSTR buys Bitcoin with everyone else’s

= automatically increasing my BTC-per-share over time.

Does that alone justify a massive premium? No.

But convenience, scale + 0% interest or debt and passive satoshi stacking justify something.

The stacking will silently add up and over time it’s gonna show.

This is the play if you believe in the long-term thesis for Bitcoin.

Despite my past enthusiasm for BTC-treasuries, I always told people to stick with legit ones. MSTR is the only one that’s actually kept stacking non-stop even with the common stock bleeding — and the debt at this point is very manageable.

Saylor’s Bitcoin Predictions

Michael Saylor, founder of this Strategy predicts $BTC will reach these prices:

$150,000 end of 2025. (probably not)

$1,000,000 next 4-8 years. (probably)

$20,000,000 next 20 years… (unlikely)

In a previous post, I made a scenario where I speculated about buying just 10 shares of MicroStrategy (MSTR) and completely forgetting about them for 20 years.

My prediction was a bit of a stretch, but here it is: I assumed MSTR would manage to accumulate 1 million Bitcoin. On the flip side, I also assumed that the total shares outstanding would double over those two decades.

This is perfectly aligned with Saylors ~31.6% per year for Bitcoin, a 244x return. I figured that good management (Saylor’s is good) deserves a premium, so I assumed the market would value MSTR at a 1.80x the value of its total Bitcoin holdings. I think BTC will → $1M eventually and I standby this prediction. But Bitcoin → $20,000,000… not happening…

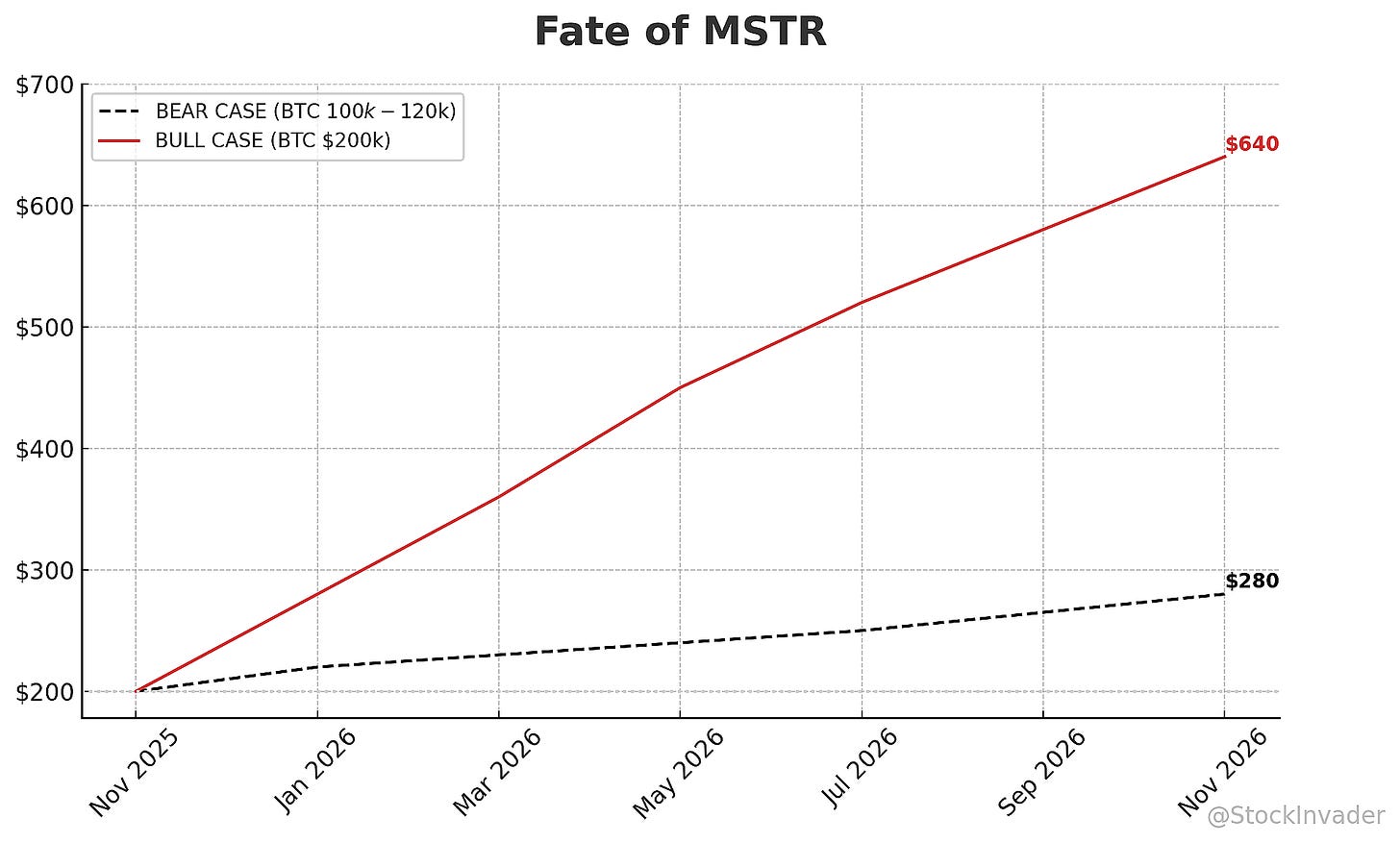

Stock Invader Forecast

Before I begin ranting and making my own future projections about where we are headed — keep in mind I’m not Lyn Alden. But as of this moment nothing is particularly cheap relative to what it has been previously.

That said, Bitcoin and Ether are both looking historically cheap relative to basically everything else. Stocks, real estate, gold all at ATHs and Silver? A $2 trillion asset. Sure, Bitcoin could drop more, but inflation-adjusted it’s not even as high as people think compared to prior highs.

The stage is actually set for both Bitcoin and Ether to go nuclear, especially if currency debasement keeps going thus I’m gearing up.

My projections rests entirely on Bitcoin, I don’t think $200,000 happens next year but perhaps a new ATH = $150,000. Speculation... However S&P Global aggregates 14 analysts and estimates a floor of $200, a probable outcome of $524 and a peak of $705. The old mNAVs we have seen in the past like 3.0x are probably not returning and that’s fine.

My Move?

$MSTR remains as %17 of portfolio — I am staying calm.

First = patience is the play.

Bitcoin isn’t a trade, MSTR isn’t a trade. I’m not chasing dips or trying to time the market perfectly.

Second = selective exposure.

I’m adding to MSTR, but only in small and measured increments. The reason: Saylor’s strategy still works, the stacking hasn’t stopped and the stock is finally offering a price below NAV, which is RARE.

Third = BTC is positioning.

I’m holding steady on my core Bitcoin position($MSTR & BTC) and layering in some Ether($SBET), which looks historically cheap relative to everything else. Inflation-adjusted, these assets are already sitting at a discount.

Ultimately → long-term mindset.

This isn’t about next quarter’s returns. It’s about 5–20 years of story compounding: passive satoshi stacking, low-cost exposure through MSTR. Avoid the people calling it a scam and or ponzi. If they can’t understand MSTR then they never understood Bitcoin in the first place. I’m staying on the train($MSTR) that moves faster than I ever could alone.

I’m Buying $MSTR at a Historic Bitcoin Discount!!!

The stacking won’t stop… Time will prove me right… I am never wrong…

🛰 Signal LOST: End of transmission — INVADER out…

Disclaimer: This post is for informational and entertainment purposes only. It reflects personal opinions and is not intended as financial advice. Always do your own research before making investment decisions.