Google: Abandon Ship?

Why Selling GOOGL for ADBE (or Anything Else) Is a Mistake

Alphabet Inc:

Only MAG7 Stock I'm Not Worried About

Missing the forest for the Trees…

I see a lot of people on X and YouTube where financebros are selling off their “supposedly” massive gains from GOOGL 0.00%↑ and pivoting into ADBE 0.00%↑or something like that.

Their rationale being that GOOGL 0.00%↑got repriced fairly now that the ’search is dead’ narrative inevitably died and ADBE 0.00%↑fits the same recovery story.

Who would have guessed that Gemini would eventually succeed and that people would still use search?

Swing-trading like this is awfully strange to me, it might work; not poking fun at Adobe. However I think almost everyone agreed that the notion of Google being fossilized 1 month into the post-launch ChatGPT-4 was a massive stretch.

But this just goes to show how massively narrative moves markets.

The Magnificent 7: A Bubble of Concentration

Looking back in the rear-view mirror it becomes clear that investing into the Big Tech stocks, any of them for that matter has been the correct strategy for almost 15 years.

The problem is that this on its own creates a bubble where all of the worlds money flows into the same assets, nothing dramatic has happened yet but a lot of sentiment hangs on NVIDIA.

People are endlessly chasing the next trend built on the AI hype ecosystem: chips → compute → energy → metals and the list somehow takes us into space…

I predict because of all of this money being poured into this endless cycle it will wind up being so cheap that smaller players jump in to specialize in various fields where the Big Tech no longer can have a competitive edge.

DeepSeek proved the vulnerability, Big Tech kept the lead by either making acquisitions or spending immense amount of CapEx comparable to that of mid-sized nations.

Among the 7 stocks in the lead I am honestly the least worried about GOOGL 0.00%↑ and that’s not because I like them, it’s just the truth.

The Google Fallacy

The problem with the finance-influencers is that they are religious to fundamentals and yet somehow oblivious to facts.

One of those facts being that Google has strongest wide MOAT on the face of the earth which Sam Altman even admitted to on the Alex Kantrowist podcast.

Altman didn’t specify but in my opinion you can’t really evaluate Google, the best method would probably be a SOTP analysis which only tells you what each segment of their business should be worth compared to it’s revenue.

Search + Data + YouTube = MOAT

Search is here to stay, while I don’t like their web-browser “Chrome” their search engine “Google” still beats most things. And even if my preference resides with Mozilla Firefox, all other web-browser are built on Google’s open-source Chromium project.

And with that they have amassed the greatest archive of data than anyone else combined. Every question, click, hesitation, scroll... only Google has the full-resolution view. No one else even has the lens or idea how to decipher it.

YouTube is too big to fail at this point… It has essentially become the nucleus of global consciousness featuring every “how to do” video past/present/future. I can’t foresee a future where something replaces YouTube it’s just permeated into society.

These 3 alone should be enough but it's just the surface…

What Google actually offers

So what is actually beneath the Search, Data & YouTube?

The amount of brainstorming going on behind the scenes is actually pretty alarming, they have their own website tracking killed projects/products which didn’t make it. Their ideas aren’t flawless but it’s a reminder of their insane work ethic, they can afford to fail 1,000 times because they only need to win once.

Sure, ChatGPT beat them to it in terms of LLMs go but people are comparing the models by benchmarks most of which don’t even understand. Truth is these AI models are equally fine, most don’t actually need Newtonian level math to conjure up shopping lists.

While everyone has ideas of what the future will look like and usually most are wrong(myself included) but Google might actually have a clue. Google is quietly racing armor to dominate the future.

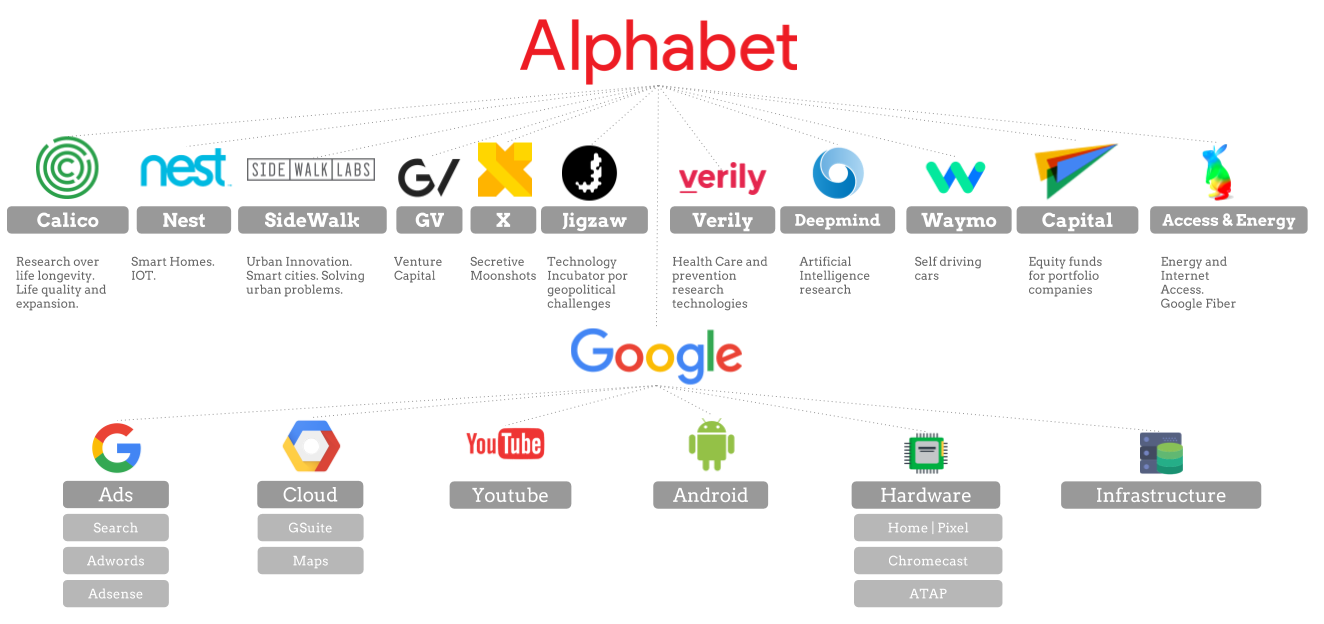

This image above is a bit outdated but quite decent, all of the segments beneath Google is what makes the business. The parent company ‘Alphabet’ owns Google and reaches far beyond it. Just to mention a few:

DeepMind

While we basically argue over which chatbot can write a better shopping list, DeepMind has been working on “consciousness” since 2010. Who honestly cares about GPT-6 at this point.

Calico Lifebiosciences

Nothing special here, just trying to solve death itself…

Waymo

Autonomous driving. Elon-fans won’t admit it but Waymo is killing it (14M+ trips in 2025, 1M weekly rides target by end-2026).

SpaceX, Anthropic & more…

Alphabet owns roughly 7% of SpaceX. massive stake in Anthropic and working on quantum tech. Point is, they aren’t just betting on themselves; they’ve hedged their bets by owning the competition and the literal rockets that will launch the datacenters of the 2030s.

It’s basically a multivitamin for a portfolio and there is a lot more to cover but with this in mind whoever sells GOOG 0.00%↑ for ADBE 0.00%↑must be a photoshop wizard.

Why I don’t personally like Google

Nothing personal like that, Sundar Pichai is still welcome in my neighborhood. But for someone who grew up with the internet and YouTube a lot of changes have been made for the worse which can only be explained by corporate greed.

From early 2023 and forward human moderators on the platform(YouTube) has effectively been replaced by AI which now only reads the transcript of a video without analyzing the context.

The implications has been censorship, algorithmic homogenization meaning the same contents gets pushed and a copyright system which works through a “guilty until proven innocent” policy.

And for what? To cut expenses and make shareholders happy? Google is definitely not the worst among the Big Tech, most of their services are actually worth it especially when compared to Microsoft in terms the price to value.

Even though I dislike what Google has done to YouTube, that doesn’t change the investment case…

My Move?

I’m definitely not selling GOOGL 0.00%↑ despite it now being 33% of my portfolio.

I was thinking of adding BABA 0.00%↑ since it’s trading at a better price and that swap/addition makes much more sense to me than something like ADBE 0.00%↑ …

Of course, GOOGL 0.00%↑ isn’t the same BARGAIN that it was during the late 2024, however with all the subsidiaries which the market prices as pitfalls rather than actionable assets, I would still mark this as a steal.

So while the photoshop wizards are buying into Adobe, I’m stacking Google shares into orbit, leaving my Instagram posts and bank statements at the mercy of GIMP 3.

BASE CASE — GOOGL 0.00%↑ $700 BY 2030

🛰 Signal LOST: End of transmission — INVADER out…

Disclaimer: This post is for informational and entertainment purposes only. It reflects personal opinions and is not intended as financial advice. Always do your own research before making investment decisions.

Regarding Google, recently there's been this opinion about Gemini overtaking ChatGPT.

I found this post on X with the following caption:

"Gemini moved from 6% to 22% of GenAI web traffic in a year while ChatGPT dropped from 87% to 65% which to me shows user changing behavior. Gemini shows up where questions already live inside Search, Chrome, Android & Workspace so new AI usage does not require a new habit, a new app or a new URL but it simply shows up."

-----

But I wonder the real reason behind this rise in traffic could be something else. Gemini has offered 18 months of free* subscription to Pro for Indian users.

(UPDATE: Some clarifications on the Gemini Pro "free" offer. Not all Indians get Gemini Pro for free. People who use Jio (a telecom provider, the Indian equivalent of T-Mobile, Verizon ), get 18 months of access to Gemini Pro "including Gemini 3 Pro, 2TB Google One storage, NotebookLM, and advanced image/video generation via Nano Banana/Veo 3.1".

Jio has about 40-41% Market share in India, highest of any other telecom provider.)

And it's one of the largest markets. So the rise in traffic could simply be because of that.

So, it may not be because of Geminis superior tech or access to Search, Chrome, Android & Workspace. It's simply due to free subscriptions. In that case, there's a good chance that these numbers could drop once the free offering ends, given how price sensitive Indians are.

Really sharp take on Google's durability, especially in this enviroment where everyone's fixated on AI hype. The Calico mention reminded me of a biotech investor I know who's always saying Alphabet is the most underpriced life extension bet in public markets. Most people dunno about these moonshot subsidiaries and just see search dominance, missing the compounding optionality underneath. When narrative shifts this hard, patient holders always win.